Disruptive technology is revolutionising processes across all industries today. From robotics to fintech, blockchain to cloud computing, breakthrough innovations are transforming how we live, work, play, and interact with each other.

Why invest in disruptive technology?

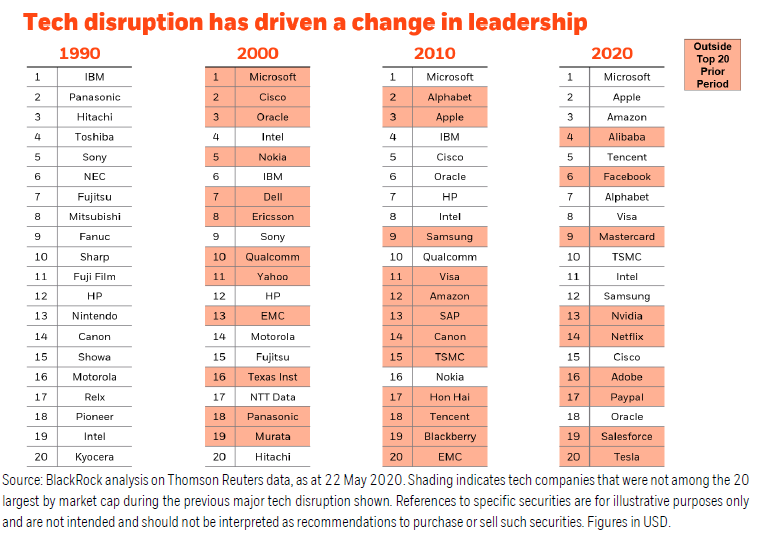

Investing in disruptive technology carries significant risk as they can take years to be adopted by consumers or businesses. That said, technology is advancing at such a rapid rate that investors not exposed to tomorrow’s front runners risk being left behind by a fast-changing world. As illustrated below, today’s business leaders may become obsolete at the turn of the next decade.

With that in mind, investing in disrupting tech can be a way to “future-proof” your portfolio and gain exposure to companies with long term growth potential.

How to invest in tech and innovation

Investors can access this megatrend through thematic ETFs or mutual funds. Alternatively, they can invest in Syfe’s Disruptive Technology portfolio, which directly holds over 100 high-growth stocks like Tesla, Nvidia, Crowdstrike, Shopify, and Coinbase.

Here are the six key themes within the portfolio, and the top holdings that best represent each theme.

By buying the underlying stocks that make up an ETF or mutual fund directly, our approach helps investors save on fund expense fees. For instance, if you want exposure to fintech, you may invest in a global fintech ETF, which comes with an expense fee of around 0.68%. This is attractive, considering that a mutual fund with similar exposure, carries management fees of 1.81%.

Overall, if you were to use ETFs to represent the key themes within our Disruptive Technology portfolio, the total ETF expense ratio would add up to about 0.7%. By investing directly in individual stocks, you don’t pay any ETF expense ratios beyond Syfe’s standard annual management fee. Our management fee covers your portfolio management: brokerage costs, dividend reinvestment, and portfolio rebalancing.

We take a closer look at each of these trends, and the innovative stocks offering direct exposure to them.

Blockchain and crypto

Blockchain is the technology behind Bitcoin, the world’s most popular cryptocurrency. Beyond Bitcoin, blockchain has wider applications in data security, e-commerce, fintech and much more.

Syfe’s Disruptive Tech portfolio invests directly in stocks that best provide exposure to the fast-growing blockchain sector. Top holdings include Coinbase, Silvergate Capital, and MicroStrategy.

Coinbase

Coinbase is one of the world’s most popular crypto exchanges. Users can buy, sell, and store their digital assets on Coinbase. The exchange also allows developers to build crypto assets using blockchain through Coinbase Cloud.

Silvergate Capital

Silvergate Capital is a next-generation crypto bank. The company runs a real-time payments system called the Silvergate Exchange Network (SEN), which serves to facilitate crypto trading between institutional investors and large crypto exchanges. In the first three months of 2022, Silvergate secured 122 new customers for SEN, reflecting robust interest in its platform.

Microstrategy

Microstrategy is an enterprise software company that has spent about $4 billion on buying Bitcoin. Since 2020, the company has been steadily adding Bitcoin to its balance sheet and currently owns nearly 130,000 Bitcoins. As such, Microstrategy serves as a Bitcoin proxy investment for many investors.

Robotics and Artificial Intelligence

Robotics and artificial intelligence (AI) play an increasingly important role in our daily lives. From robotic automation in the industrial space to AI-assisted surgery, these technologies have transformed multiple industries.

With Syfe’s Disruptive Technology portfolio, you will be investing in leading robotics and AI companies such as Nvidia, Intuitive Surgical, and Upstart. These companies represent some of the top holdings within the portfolio.

Nvidia

Nvidia is a semiconductor company that has been shifting its focus to AI and robotics in recent years. The company produces AI software that has been adopted by companies such as Amazon, Microsoft, and Snap. Nvidia’s robotics solutions include applications for retail, grocery deliveries, healthcare and more.

Intuitive Surgical

Intuitive Surgical is the world’s leader in robotic surgical technology. The company owns an estimated 80% market share in the global surgical robotics market. Between 2010 and 2020, the number of general surgeries in the US performed with the company’s surgical robotic system grew from 10,000 to over 434,000. This is a clear indication that robotic surgery is becoming mainstream as more patients demand less invasive surgery.

Upstart

Upstart is an AI company that’s disrupting the traditional lending industry. The firm uses AI to help banks disburse loans more efficiently. When someone applies for a loan, Upstart’s algorithm instantly analyses over 1,500 data points relating to their circumstances to deliver a thorough analysis of their credit-worthiness. The company’s internal studies show that their platform can reduce defaults by 75% while keeping loan approval rates constant, as compared to traditional credit models.

Fintech

Technology has fundamentally changed the ability of financial institutions to interact with customers and conduct transactions. According to a joint study by the World Economic Forum (WEF) and Deloitte, fintechs have defined the direction, shape and pace of innovation across almost every sub-sector of financial services.

Top holdings within Syfe’s Disruptive Technology portfolio include leading fintech companies such as Square, Shopify, and Twilio.

Square

Square is a digital payments company with products for both consumer buyers and merchant sellers. For merchants, the company makes credit-card readers that connect to mobile phones, and also offers loans for businesses. For consumers, Square’s Cash App is a peer-to-peer money-transfer service. Consumers can use Cash App to trade stocks too.

Shopify

Shopify is an e-commerce software company. It charges merchants subscription fees to easily create a website and start selling their products online. To further support merchants, Shopify provides shipping, digital payment and fulfillment services too. As such, the company occupies a different – and less crowded space – as compared to online marketplaces like Amazon and eBay.

Twilio

Twilio is a cloud communications company that enables app developers to embed voice, text messaging, video, and two-factor authentication into their products. The company is behind many seamless onboarding and login experiences offered by fintechs and financial institutions.

Next-gen internet

Cloud computing, big data, the internet of things, and social commerce are some of the transformative technologies being spearheaded by the world’s most innovative internet companies today.

The Disruptive Technology portfolio invests directly in such stocks. Top holdings include Tesla, JD.com, and Alibaba.

Tesla

Although Tesla is widely known as an electric vehicle company, it’s also a big data company. All Tesla vehicles send data directly to the cloud, and Tesla uses this data to not just refine its systems, but also advance its self-driving technology. Sensor data collected from Tesla cars on the road is currently being used to train its autonomous driving system. While competitors have gathered just millions of miles of data, Tesla has gathered billions.

JD.com and Alibaba

Social commerce, where purchases are made online via social media, is a huge industry in China. According to ARK Research, social commerce gross merchandise value is expected to grow at a compound annual rate of 41% over the next five years to $3.7 trillion. JD.com and Alibaba, two of the largest Chinese e-commerce companies, are increasingly focusing on this trend. Alibaba has Taobao Live, which generated over 400 billion yuan ($61 billion) in gross merchandise value in 2020. Meanwhile, JD.com has Jingxi, its social commerce platform, which is positioned to compete with Pinduoduo in lower-tier cities.

Cloud-computing and cybersecurity

The WEF estimates that 80% of the technologies that will change the way we live and work will be cloud-based, and that the value of cloud computing will grow to US$623 billion by 2025.

Meanwhile, as cyber threats rise, cybersecurity is an essential component to the continuity of disruptive technologies, and one of the most durable disruptive growth themes.

Syfe’s Disruptive Technology portfolio invests in companies at the forefront of these technologies, such as Crowdstrike, Akamai Technologies, and Zscaler.

Crowdstrike

Crowdstike is a cloud-based cyber-security company. Its Falcon platform uses machine learning, AI, and behavioural analysis to detect and prevent cyber breaches. As a cloud solution, Falcon is often more cost-effective than on-premise cybersecurity products. Moreover, Falcon’s machine learning capabilities mean that it can recognise and respond to potential attacks more swiftly over time. In less than five years, CrowdStrike has grown its subscriber count from 450 to more than 16,000. Additionally, 98% of subscribers renew their subscriptions, a clear indicator of Crowdstrike’s robust offerings.

Akamai Technologies

Akamai is a cloud-focused web services company. It’s the largest provider of CDN (content delivery network) services and recently ventured into cybersecurity. CDN services enable faster and more reliable transactions and downloads to enhance the web experience.

Zscaler

Zscaler is a cloud-based cybersecurity company that monitors an organisation’s internal and web-based traffic. This sets it apart from Crowdstrike, which secures endpoint devices like computers and mobile devices. Zscaler has doubled its customer base in just four years to 5,600. Additionally, it’s been gaining larger customers. In its most recent earnings report, Zscaler had 251 customers that generated over $1 million in annual recurring revenue, a 85% increase from a year ago.

Video games and e-sports

According to data from Statista, the global gaming market is estimated to be worth US$269 billion annually by 2025. Syfe’s Disruptive Technology portfolio captures the growth of the video game and e-sports industry by investing in companies such as NetEase, Sea, and Roblox.NetEase

NetEase is the second-largest online gaming firm in China, behind only Tencent. The firm develops online games for both PC and mobile. It also works with Activision Blizzard to operate Chinese versions of their hit games like World of Warcraft.

Sea

Sea is an e-commerce and video game company. Garena, its video game unit, is the core profit engine for Sea’s multiple businesses. Garena has an exclusive license to publish many popular third-party games such as League of Legends and Call of Duty thanks to partnerships with Tencent, NetEase and more. What’s more, Garena publishes its own game, Free Fire, one of the world’s most popular battle royale games.

Roblox

Roblox is a social gaming company. Its innovative gaming platform lets users develop, share, and monetise their own games without any coding knowledge. One of its most popular games in 2021 was Brookhaven, a game that lets people explore and live in a virtual city. As such, Roblox is also considered a play on the metaverse.